July 30, 2013

Will India become a coffee country?

Despite the fact that India is traditionally a tea country, coffee consumption growth is outpacing that of tea, and is being driven forward by the country’s growing middle class and younger consumers. Demand for tea in India is still strong as it is consumed by 90% of Indian households, and quality tea can be found just about anywhere for just a few rupees. However, coffee has found its place among the nation’s youth and emerging middle class, largely owing to the rising popularity of modern coffee bars and cafés as hang-out spots. As India’s coffee boom has gone pan-Indian, coffee consumption in India has shown robust growth, rising by about 5%-6% annually, while tea consumption is increasing only at about 2%. Outlooks expect coffee and tea drinking growth rates to hold pace.

Despite the fact that India is traditionally a tea country, coffee consumption growth is outpacing that of tea, and is being driven forward by the country’s growing middle class and younger consumers. Demand for tea in India is still strong as it is consumed by 90% of Indian households, and quality tea can be found just about anywhere for just a few rupees. However, coffee has found its place among the nation’s youth and emerging middle class, largely owing to the rising popularity of modern coffee bars and cafés as hang-out spots. As India’s coffee boom has gone pan-Indian, coffee consumption in India has shown robust growth, rising by about 5%-6% annually, while tea consumption is increasing only at about 2%. Outlooks expect coffee and tea drinking growth rates to hold pace.

A decade ago, the country’s coffee-drinking culture could largely be summed-up by the consumption of sweet and frothy filter coffee in South India. However, nowadays, Western-style coffee bars have sprouted up all over India as a newly emergent young middle class has become enchanted with cappuccinos and café lattes as much as they have fallen for the idea of catching up with friends and colleagues at cafés. Barista Coffee is considered to be the pioneer of espresso bars and cafés in India and has 1,950 outlets across the country. The second largest chain is Coffee Café Day, another ubiquitous Indian coffee bar chain, with 1,438 outlets across 28 states of India. Starbucks, through a joint venture with Tata Global Beverages, already has 15 outlets (8 in Mumbai and 7 in Delhi).

Through extensive fieldwork in end-channels across all income levels in six major Indian cities, , Promar consultants recently learned that India’s blossoming coffee culture is also paving the way for ready-to-drink coffee beverages and in the process of doing so is changing the landscape of the soft drink industry in India. Nescafé Ice Coffee is a chocolate mocha-flavored coffee beverage and is the leading RTD coffee brand in the country. The category – which currently groups RTD tea and coffees together – still accounts for just 0.1% of India’s 9bln liter soft drink market but is expected to become the fastest growing category over the next five years. RTD tea and coffee drinks, in terms of absolute volume, are expected to hit the 47.8mln mark in 2016, up from their current levels of just 16mln liters. Category growth is likely to push RTD tea and coffee drinks from being the 6th to the 5th largest category in the market, trailing only water, two carbonated categories, and juices, over the forecast period. Given the novelty of the RTD coffee category, companies are experimenting with products in order to find a hit with Indian coffee consumers. For example, Indian soft drink company Parle Agro has recently made a foray into the RTD coffee market with its newly released non-caffeinated carbonated coffee-flavored beverage called Café Cuba. Other companies such as Coke, Pepsi, Unilever and Nestle are expected to also be considering variants of RTD coffee products.

Through extensive fieldwork in end-channels across all income levels in six major Indian cities, , Promar consultants recently learned that India’s blossoming coffee culture is also paving the way for ready-to-drink coffee beverages and in the process of doing so is changing the landscape of the soft drink industry in India. Nescafé Ice Coffee is a chocolate mocha-flavored coffee beverage and is the leading RTD coffee brand in the country. The category – which currently groups RTD tea and coffees together – still accounts for just 0.1% of India’s 9bln liter soft drink market but is expected to become the fastest growing category over the next five years. RTD tea and coffee drinks, in terms of absolute volume, are expected to hit the 47.8mln mark in 2016, up from their current levels of just 16mln liters. Category growth is likely to push RTD tea and coffee drinks from being the 6th to the 5th largest category in the market, trailing only water, two carbonated categories, and juices, over the forecast period. Given the novelty of the RTD coffee category, companies are experimenting with products in order to find a hit with Indian coffee consumers. For example, Indian soft drink company Parle Agro has recently made a foray into the RTD coffee market with its newly released non-caffeinated carbonated coffee-flavored beverage called Café Cuba. Other companies such as Coke, Pepsi, Unilever and Nestle are expected to also be considering variants of RTD coffee products.

While the conclusion can be made that India is still not likely to become a coffee country, the popularity of cafés and their delicacies, as well as various other forms of instant and RTD coffee drinks are on the rise, and are becoming increasingly popular with India’s growing middle class consumer segment. It will certainly be interesting to see where the Indian coffee market goes from here.

Promar Consulting has done numerous projects investigating various agriculture, food and beverage markets in India. If you are interested in learning more, please contact us.

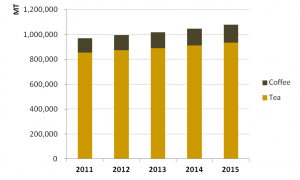

Tea vs. Coffee:

Coffee board of India, Tea Board of India