Promar team recently visited the Philippines to conduct a research project on local sugarcane industry. Historically, the Philippines was famous for its production of sugar. During Spanish and American ruling era, the local sugarcane industry had boomed under large sugarcane plantations which assisted the country’s economic growth. Sugar was one of the important agricultural commodities and its largest importer was the United States. Sugar is still an important agricultural export product for the Philippines, however, the local sugarcane industry has shrunk down compared to its peak periods. The industry experienced ups and downs throughout past decades and it has been struggling to stabilize its sugar production to meet local and the US demand. Promar team set out to understand the current challenges faced by the Philippines sugarcane industry.

Promar team recently visited the Philippines to conduct a research project on local sugarcane industry. Historically, the Philippines was famous for its production of sugar. During Spanish and American ruling era, the local sugarcane industry had boomed under large sugarcane plantations which assisted the country’s economic growth. Sugar was one of the important agricultural commodities and its largest importer was the United States. Sugar is still an important agricultural export product for the Philippines, however, the local sugarcane industry has shrunk down compared to its peak periods. The industry experienced ups and downs throughout past decades and it has been struggling to stabilize its sugar production to meet local and the US demand. Promar team set out to understand the current challenges faced by the Philippines sugarcane industry.

For the Philippines, its priority is to satisfy local demand for sugar and to meet the import quota for the US market. Domestic supply and demand of sugar are estimated every year, and the government affiliated regulatory body, the Sugar Regulatory Administration (SRA), oversees and controls the overall supply of sugar. They control the supply under a unique system called “Quedan System”, which allocates what percentages of local production should be supplied to domestic market, to the U.S. market, as well as to the international market. The Quedan System is mainly set up to protect local sugarcane farmers and maintain a stable price through controlling the supply volume.

Through our field research in the Philippines, we identified that sugar production has been facing a number of challenges due to

- adverse climate change effects (El Niño, La Niña, and typhoons)

- fragmented sugarcane farmland under the agrarian reform

- labor shortage (especially during harvest season)

- lack of infrastructure

- delay in farm mechanization

- lack of financial assistance

In addition, the Philippine Congress passed a new tax bill which included an excise tax on sweetened beverages. The new tax applies to certain drinks with added sugar such as soft drinks and energy drinks which contain caloric and/or non-caloric sweetener (mostly sugar and/or high fructose corn syrup as well as aspartame).

In addition, the Philippine Congress passed a new tax bill which included an excise tax on sweetened beverages. The new tax applies to certain drinks with added sugar such as soft drinks and energy drinks which contain caloric and/or non-caloric sweetener (mostly sugar and/or high fructose corn syrup as well as aspartame).

This bill was proposed due to a growing concern over adverse health effects resulting from a large consumption of sugar. Although the country has lower prevalence on major health issues such as diabetes and obesity compared to other ASEAN countries (e.g. Indonesia and Thailand), some experts estimate that over 7 million of Filipinos are obese and/or diabetic.

It is anticipated that increasing the price of sweetened beverages would drive consumers to make fewer purchases and reduce sugar intake accordingly. With the new bill came into effect in January 2018, beverages containing caloric and non-caloric sweeteners (e.g. sugar, aspartame, etc.) are now taxed at 6 pesos per liter and beverages containing high fructose corn syrup are taxed at 12 pesos per liter.

While those challenges are not easy to overcome, we found that different efforts have been made by stakeholders of sugarcane industry. Some sugarcane millers are collaborating with local farmers by providing training courses to help farmers increase their yield. One of the mills we visited in Negros island has invested in new product development to expand its market and consumers. Another mill we interviewed has been discussing with local governments and farmers the possibilities of expanding sugarcane fields in newly identified farmland. In addition, there is a new law passed in 2015 to revive local sugarcane industry which provides government financial assistance to infrastructure, farm mechanization, etc.

While those challenges are not easy to overcome, we found that different efforts have been made by stakeholders of sugarcane industry. Some sugarcane millers are collaborating with local farmers by providing training courses to help farmers increase their yield. One of the mills we visited in Negros island has invested in new product development to expand its market and consumers. Another mill we interviewed has been discussing with local governments and farmers the possibilities of expanding sugarcane fields in newly identified farmland. In addition, there is a new law passed in 2015 to revive local sugarcane industry which provides government financial assistance to infrastructure, farm mechanization, etc.

Although it will take more time and require consistent efforts by the government and local industry players to stabilize the sugar production, we were able to see positive changes in the industry.

Photo 1: Farmers harvesting sugarcanes in Negros island

Photo 2: Trucks full of sugarcane waiting to deliver their harvest to a sugar mill

Photo 3: Low-GI sugar and antioxidant supplement derived from sugarcane extract developed by Sagay Central

In many parts of the world, fruits are commonly used in savory dishes. However, cooking with fruits is still quite new in Japan.

In many parts of the world, fruits are commonly used in savory dishes. However, cooking with fruits is still quite new in Japan. Promar Consulting represents Japan office for the Wild Blueberry Association of North America. The company’s promotion team plans and manages promotional activities to support the association and expand its market in Japan. Japan’s import volume of frozen and dehydrated wild blueberry has been increasing since Promar began working with the association in 2015.

Promar Consulting represents Japan office for the Wild Blueberry Association of North America. The company’s promotion team plans and manages promotional activities to support the association and expand its market in Japan. Japan’s import volume of frozen and dehydrated wild blueberry has been increasing since Promar began working with the association in 2015.  In February 2016, Promar helped organize a business mission to Kenya for 15 Japanese private sector companies interested in business opportunities in the Kenyan food and agriculture value chain, as part of a Japanese Ministry of Agriculture, Forestry and Fishery-funded initiative to support development of food value chains in Africa. The Japanese companies came from various industries, including beverage, cold chain equipment, trading and logistics; some were experienced in African markets and some were interested in exploring Kenya as a new market. Japanese investment in Kenyan food and agriculture is generally in its early stages, although there are already several major ongoing Japanese investment projects, including in agricultural inputs (agrochemicals and fertilizer) as well as in agricultural products such as rice. Many mission participants felt they saw positive business opportunities within Kenya’s food chain, even in the very short term.

In February 2016, Promar helped organize a business mission to Kenya for 15 Japanese private sector companies interested in business opportunities in the Kenyan food and agriculture value chain, as part of a Japanese Ministry of Agriculture, Forestry and Fishery-funded initiative to support development of food value chains in Africa. The Japanese companies came from various industries, including beverage, cold chain equipment, trading and logistics; some were experienced in African markets and some were interested in exploring Kenya as a new market. Japanese investment in Kenyan food and agriculture is generally in its early stages, although there are already several major ongoing Japanese investment projects, including in agricultural inputs (agrochemicals and fertilizer) as well as in agricultural products such as rice. Many mission participants felt they saw positive business opportunities within Kenya’s food chain, even in the very short term. One of the sectors which struck the Japanese companies was the chicken industry. Demand for chicken has been growing in Kenya, as the number of middle-income consumers increases and the food service industry becomes more dynamic. For example, Toridoll, a Japanese-owned teriyaki chicken fast food chain, has been enjoying strong popularity among urban Nairobi consumers of many different age groups. Nakumatt, the country’s largest retailer uses the slogan ‘value for money’, to offer whole chickens – not boneless chicken which is more expensive – to appeal to a wide-range of consumers. One participant from a leading Japanese trading company said, “I was able to see that the Kenyan chicken business has high potential. Now I would like to visit poultry farms and do further research on the industry.”

One of the sectors which struck the Japanese companies was the chicken industry. Demand for chicken has been growing in Kenya, as the number of middle-income consumers increases and the food service industry becomes more dynamic. For example, Toridoll, a Japanese-owned teriyaki chicken fast food chain, has been enjoying strong popularity among urban Nairobi consumers of many different age groups. Nakumatt, the country’s largest retailer uses the slogan ‘value for money’, to offer whole chickens – not boneless chicken which is more expensive – to appeal to a wide-range of consumers. One participant from a leading Japanese trading company said, “I was able to see that the Kenyan chicken business has high potential. Now I would like to visit poultry farms and do further research on the industry.” While Promar has found that sourcing stable quality and quantities of raw materials is still a challenge throughout Kenyan value chains, these visits and discussions allowed the participants to understand the attractiveness of the Kenyan agri-food industry as well as the retail sector. As one participant from the vegetable/fruit sector commented, “The value chains for export products like horticultural crops are quite advanced. Although the competition seems tight and we need to consider entrance strategies, there is a good base here for business.”

While Promar has found that sourcing stable quality and quantities of raw materials is still a challenge throughout Kenyan value chains, these visits and discussions allowed the participants to understand the attractiveness of the Kenyan agri-food industry as well as the retail sector. As one participant from the vegetable/fruit sector commented, “The value chains for export products like horticultural crops are quite advanced. Although the competition seems tight and we need to consider entrance strategies, there is a good base here for business.” Once again in April Promar welcomed representatives of the Wild Blueberry Association of North America (WBANA) from Canada and supported their annual attendance at Tokyo’s FABEX food and beverage trade show.

Once again in April Promar welcomed representatives of the Wild Blueberry Association of North America (WBANA) from Canada and supported their annual attendance at Tokyo’s FABEX food and beverage trade show.

Promar’s recent field research in Kenya, led by consultants Reiko Tominaga and Lucia Vancura, focused on identifying investment opportunities in the country’s food and agricultural sectors. The work revealed a variety of innovative applications of mobile apps for agribusiness, including Mgubu Choice that provides information and local availability of seeds for purchase and We Farm which uses crowd sourcing through SMS messages to answer farmer questions. iCow offers a wide range of services to small scale Kenyan farmers, such as tracking individual dairy cow health, diet and milking data, providing vaccination calendars for chickens and cows and alerting farmers on the locations of the nearest veterinarians.

Promar’s recent field research in Kenya, led by consultants Reiko Tominaga and Lucia Vancura, focused on identifying investment opportunities in the country’s food and agricultural sectors. The work revealed a variety of innovative applications of mobile apps for agribusiness, including Mgubu Choice that provides information and local availability of seeds for purchase and We Farm which uses crowd sourcing through SMS messages to answer farmer questions. iCow offers a wide range of services to small scale Kenyan farmers, such as tracking individual dairy cow health, diet and milking data, providing vaccination calendars for chickens and cows and alerting farmers on the locations of the nearest veterinarians. Another example was the Japan-founded social enterprise AfricaScan,which has established the Blue Spoon branded franchise model for neighborhood grocery kiosks. One pillar of the model is use by kiosk owners of an inventory management app on an iPad to track customer purchasing patterns and manage inventory orders. Kiosk owners felt that the efficiency of the Blue Spoon model had improved the ease of doing business.

Another example was the Japan-founded social enterprise AfricaScan,which has established the Blue Spoon branded franchise model for neighborhood grocery kiosks. One pillar of the model is use by kiosk owners of an inventory management app on an iPad to track customer purchasing patterns and manage inventory orders. Kiosk owners felt that the efficiency of the Blue Spoon model had improved the ease of doing business.

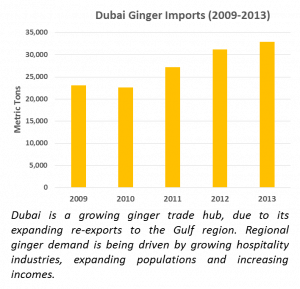

Nevertheless, a few pioneering Nepal ginger traders have successfully begun exporting small amounts of dried ginger to competitive markets – Japan and the EU – and ginger has been identified by Nepal’s government as a high potential export crop. There is interest in supporting the Nepalese industry to grow its capacity to process ginger (dried or fresh) for export to top ginger markets, including Japan, Dubai and the EU.

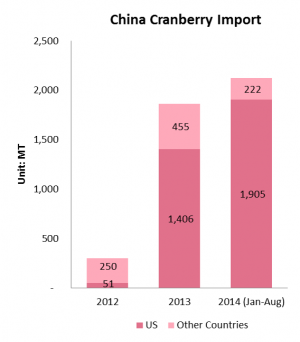

Nevertheless, a few pioneering Nepal ginger traders have successfully begun exporting small amounts of dried ginger to competitive markets – Japan and the EU – and ginger has been identified by Nepal’s government as a high potential export crop. There is interest in supporting the Nepalese industry to grow its capacity to process ginger (dried or fresh) for export to top ginger markets, including Japan, Dubai and the EU. China’s cranberry boom began in 2012, and has grown dramatically over the past three years. Chinese import data on prepared and preserved cranberries (mostly branded dried cranberries), shows that from January to August this year (just 8 months!), the total number of dried cranberry imports (approximately 2,000 MT) was already about 7 times the volume of 2012 (approximately 300 MT). China’s largest cranberry supplier is overwhelmingly the US, which had a share of approximately 90% of the total imports in the first month of 2014, followed by other suppliers including Chile, Canada, and Norway.

China’s cranberry boom began in 2012, and has grown dramatically over the past three years. Chinese import data on prepared and preserved cranberries (mostly branded dried cranberries), shows that from January to August this year (just 8 months!), the total number of dried cranberry imports (approximately 2,000 MT) was already about 7 times the volume of 2012 (approximately 300 MT). China’s largest cranberry supplier is overwhelmingly the US, which had a share of approximately 90% of the total imports in the first month of 2014, followed by other suppliers including Chile, Canada, and Norway.