Promar consultants often go in the field (literally!) in order to assist clients in solving business dilemmas. Senior Consultant Tina Peneva tells about her experience in solving a raw material supply issue in Bulgaria.

Safflower (Carthamus tinctorius) is an annual oilseed crop that resembles a thistle. Its seeds are rich in oil and the flowers are used for the manufacture of yellow dyes. It is not a major crop and the global safflower production totals about 500,000 MT annually. There are more than 60 countries involved in safflower production, the largest ones being India, USA, Mexico, as well as China, Kazakhstan and Ethiopia.

Safflower (Carthamus tinctorius) is an annual oilseed crop that resembles a thistle. Its seeds are rich in oil and the flowers are used for the manufacture of yellow dyes. It is not a major crop and the global safflower production totals about 500,000 MT annually. There are more than 60 countries involved in safflower production, the largest ones being India, USA, Mexico, as well as China, Kazakhstan and Ethiopia.

In addition to its more traditional end uses for oil and for birdseed, in the past 10 years safflower seeds have increasingly been used in food supplements, including Bulgarian seeds.

Overall, Bulgaria supplies just a small share of the global safflower production. The majority of Bulgarian safflower is marketed mainly as bird feed. However, premium quality safflower seeds can be used for human consumption and food supplement production. Producing safflower seeds for human consumption requires very careful post-harvest handling in order to avoid the growth of aflatoxin mold which is dangerous for humans.

In Promar’s case, the safflower exporter and importer faced various difficulties, right from the initial phase of safflower sourcing from Bulgaria. The Bulgarian side could not understand the strict requirements the Japanese buyer laid out in regard to harvesting, storage and transportation of safflower. On the other hand, the Japanese buyer was not able to have hands-on control over the process in Bulgaria due to distance, as well as a shortage of manpower.

In Promar’s case, the safflower exporter and importer faced various difficulties, right from the initial phase of safflower sourcing from Bulgaria. The Bulgarian side could not understand the strict requirements the Japanese buyer laid out in regard to harvesting, storage and transportation of safflower. On the other hand, the Japanese buyer was not able to have hands-on control over the process in Bulgaria due to distance, as well as a shortage of manpower.

These major communication problems and lack of a person in charge of quality control were threatening to derail the project.

When Promar Consulting stepped in, we first made sure that “everybody was speaking the same language”, i.e. there were no information gaps or unclear points in terms of what the Japanese buyer’s requirements were and whether the requirements were achievable. The most important challenge in the process was to prevent aflatoxin mold from growing in the harvested safflower, which would make the seeds unusable for human consumption.

After a number of meetings and discussions, the project team including the importer, the exporter and Promar consultants outlined a traceability system for monitoring the pre-harvest, harvest and post-harvest handling of safflower seeds before they are exported. The traceability system included clear actions at each step that were meticulously recorded for future analysis.

Pre-harvest: checking everything twice

We prepared detailed check lists to be completed by the Bulgarian exporter with details about the agrochemical product use, soil treatment, the condition of the harvesting combine and the transporting truck, weather details, among other points. Promar consultants facilitated this process and made sure the tasks were understood correctly and completed in a timely manner.

Harvest: recording every detail of the process

As usually happens in agriculture, the exact harvest period is hard to predict. This was one of the difficulties that the overseas safflower buyer facedl; it was impossible to fly over to Bulgaria on short notice to directly monitor the safflower harvest. Instead, our Bulgaria-based consultant was on stand-by for a week prior to harvest, waiting to be called to observe the harvest at the best possible, i.e. the driest, time.

As usually happens in agriculture, the exact harvest period is hard to predict. This was one of the difficulties that the overseas safflower buyer facedl; it was impossible to fly over to Bulgaria on short notice to directly monitor the safflower harvest. Instead, our Bulgaria-based consultant was on stand-by for a week prior to harvest, waiting to be called to observe the harvest at the best possible, i.e. the driest, time.

During the harvest, we recorded each step of the process, including keeping track of atmospheric temperature, and humidity. This information was necessary in order to track any possibility of aflatoxin mold growth during the harvest.

Post-harvest: documenting and analyzing

Promar’s involvement in the post-harvest processes included documenting and monitoring the safflower cleaning and drying process at the cleaning facility, as well as putting the seeds into bags and preparing them for storage. During this process our consultant took seed samples which were sent for analysis prior shipment.

The joint effort between buyer, seller and Promar consultants proved to be efficient on many levels. Communication was smooth, since gaps in language and business culture were eliminated. All parties involved better understood the buyer’s requirements and therefore followed them closely, which resulted in a successful harvest of safflower seeds from Bulgaria.

Promar has done numerous projects assisting companies, industrial organizations and farmers in solving supply issues. If you are interested in learning more, please contact us.

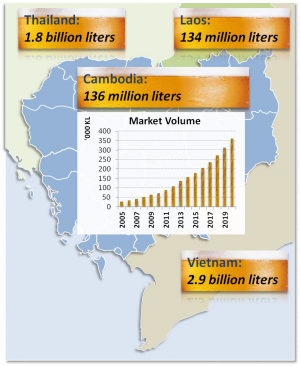

Cambodia also has plenty of imported beer – 28% of the beer market comes from oversees – mostly Thailand and Vietnam. Legal beer imports in 2013 amounted to 7.7 million liters, but it is estimated that 5 times more came across the borders unofficially. Import beer brands in Cambodia are diverse, both in flavor, and price-point. Among premium beers, Heineken and Budweiser, both imported by local distributors under exclusive handling contracts are quite prevalent at modern and traditional retail outlets through the country. Heineken and Budweiser bottles (330ml) are usually sold retail for USD 1.40. Both of these brands are also currently making a big push to target Khmer premium on-premise outlets. Standard and economy brands from Vietnam, Thailand and Laos are increasingly found in the market. For example, Leo beer, brewed by Singha in Thailand, is currently popular with younger drinkers in Phnom Penh. The brand’s popularity can be linked to its affordability (USD 0.55/330ml can) as well as the strong marketing presence behind the brand. Even renowned Belgian beers like Maredsous Brune and Duvel can be found at some high-end off-premise locations in the capital, albeit retailing at close to 6 times the price of a Heineken. Cambodia’s imported beer market is likely to grow in-step with overall market growth, and benefit from tariff reductions scheduled for 2015 as agreed to by ASEAN countries.

Cambodia also has plenty of imported beer – 28% of the beer market comes from oversees – mostly Thailand and Vietnam. Legal beer imports in 2013 amounted to 7.7 million liters, but it is estimated that 5 times more came across the borders unofficially. Import beer brands in Cambodia are diverse, both in flavor, and price-point. Among premium beers, Heineken and Budweiser, both imported by local distributors under exclusive handling contracts are quite prevalent at modern and traditional retail outlets through the country. Heineken and Budweiser bottles (330ml) are usually sold retail for USD 1.40. Both of these brands are also currently making a big push to target Khmer premium on-premise outlets. Standard and economy brands from Vietnam, Thailand and Laos are increasingly found in the market. For example, Leo beer, brewed by Singha in Thailand, is currently popular with younger drinkers in Phnom Penh. The brand’s popularity can be linked to its affordability (USD 0.55/330ml can) as well as the strong marketing presence behind the brand. Even renowned Belgian beers like Maredsous Brune and Duvel can be found at some high-end off-premise locations in the capital, albeit retailing at close to 6 times the price of a Heineken. Cambodia’s imported beer market is likely to grow in-step with overall market growth, and benefit from tariff reductions scheduled for 2015 as agreed to by ASEAN countries. If you mention the trendy term “super fruit” in Korea, it is more than likely that “blueberry” will be the first word that pops up. Blueberries have become incredibly popular in South Korea for their health benefits in a very short time and can be considered a success story for blueberry suppliers, which are dominated by the US, Canada and Chile.

If you mention the trendy term “super fruit” in Korea, it is more than likely that “blueberry” will be the first word that pops up. Blueberries have become incredibly popular in South Korea for their health benefits in a very short time and can be considered a success story for blueberry suppliers, which are dominated by the US, Canada and Chile. Vietnam has no end of tasty street snacks, the country’s traditional fast food, from pho noodles, to grilled chicken skewers to bahn mi baguette sandwiches. Rumor has it that this strong tradition of high quality, low cost traditional fast food was one reason that Western fast food chains have been slow to enter the country.

Vietnam has no end of tasty street snacks, the country’s traditional fast food, from pho noodles, to grilled chicken skewers to bahn mi baguette sandwiches. Rumor has it that this strong tradition of high quality, low cost traditional fast food was one reason that Western fast food chains have been slow to enter the country. However in addition to competition from “traditional fast food”, two other factors that limit fast food growth are real estate and infrastructure. The cafes and fast food chains which pitch themselves as premium must locate their shops in premium areas, such as District 1 in Ho Chi Minh City (HCMC) or higher-end office parks in District 7. Ideally they want real estate on the corner of a busy and trendy area. These spots are going fast and many chains are finding it difficult to find affordable real estate that offers the right kind of exposure.

However in addition to competition from “traditional fast food”, two other factors that limit fast food growth are real estate and infrastructure. The cafes and fast food chains which pitch themselves as premium must locate their shops in premium areas, such as District 1 in Ho Chi Minh City (HCMC) or higher-end office parks in District 7. Ideally they want real estate on the corner of a busy and trendy area. These spots are going fast and many chains are finding it difficult to find affordable real estate that offers the right kind of exposure. Until just a few months ago, buying a Coke in Myanmar meant purchasing a can that was smuggled in from Thailand. However, this is all changing as global food and beverage companies are now some of the most aggressive investors in Asia’s last frontier market.

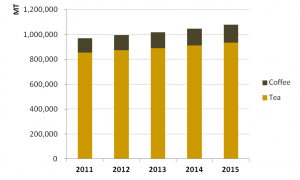

Until just a few months ago, buying a Coke in Myanmar meant purchasing a can that was smuggled in from Thailand. However, this is all changing as global food and beverage companies are now some of the most aggressive investors in Asia’s last frontier market. Despite the fact that India is traditionally a tea country, coffee consumption growth is outpacing that of tea, and is being driven forward by the country’s growing middle class and younger consumers. Demand for tea in India is still strong as it is consumed by 90% of Indian households, and quality tea can be found just about anywhere for just a few rupees. However, coffee has found its place among the nation’s youth and emerging middle class, largely owing to the rising popularity of modern coffee bars and cafés as hang-out spots. As India’s coffee boom has gone pan-Indian, coffee consumption in India has shown robust growth, rising by about 5%-6% annually, while tea consumption is increasing only at about 2%. Outlooks expect coffee and tea drinking growth rates to hold pace.

Despite the fact that India is traditionally a tea country, coffee consumption growth is outpacing that of tea, and is being driven forward by the country’s growing middle class and younger consumers. Demand for tea in India is still strong as it is consumed by 90% of Indian households, and quality tea can be found just about anywhere for just a few rupees. However, coffee has found its place among the nation’s youth and emerging middle class, largely owing to the rising popularity of modern coffee bars and cafés as hang-out spots. As India’s coffee boom has gone pan-Indian, coffee consumption in India has shown robust growth, rising by about 5%-6% annually, while tea consumption is increasing only at about 2%. Outlooks expect coffee and tea drinking growth rates to hold pace. Through extensive fieldwork in end-channels across all income levels in six major Indian cities, , Promar consultants recently learned that India’s blossoming coffee culture is also paving the way for ready-to-drink coffee beverages and in the process of doing so is changing the landscape of the soft drink industry in India. Nescafé Ice Coffee is a chocolate mocha-flavored coffee beverage and is the leading RTD coffee brand in the country. The category – which currently groups RTD tea and coffees together – still accounts for just 0.1% of India’s 9bln liter soft drink market but is expected to become the fastest growing category over the next five years. RTD tea and coffee drinks, in terms of absolute volume, are expected to hit the 47.8mln mark in 2016, up from their current levels of just 16mln liters. Category growth is likely to push RTD tea and coffee drinks from being the 6th to the 5th largest category in the market, trailing only water, two carbonated categories, and juices, over the forecast period. Given the novelty of the RTD coffee category, companies are experimenting with products in order to find a hit with Indian coffee consumers. For example, Indian soft drink company Parle Agro has recently made a foray into the RTD coffee market with its newly released non-caffeinated carbonated coffee-flavored beverage called Café Cuba. Other companies such as Coke, Pepsi, Unilever and Nestle are expected to also be considering variants of RTD coffee products.

Through extensive fieldwork in end-channels across all income levels in six major Indian cities, , Promar consultants recently learned that India’s blossoming coffee culture is also paving the way for ready-to-drink coffee beverages and in the process of doing so is changing the landscape of the soft drink industry in India. Nescafé Ice Coffee is a chocolate mocha-flavored coffee beverage and is the leading RTD coffee brand in the country. The category – which currently groups RTD tea and coffees together – still accounts for just 0.1% of India’s 9bln liter soft drink market but is expected to become the fastest growing category over the next five years. RTD tea and coffee drinks, in terms of absolute volume, are expected to hit the 47.8mln mark in 2016, up from their current levels of just 16mln liters. Category growth is likely to push RTD tea and coffee drinks from being the 6th to the 5th largest category in the market, trailing only water, two carbonated categories, and juices, over the forecast period. Given the novelty of the RTD coffee category, companies are experimenting with products in order to find a hit with Indian coffee consumers. For example, Indian soft drink company Parle Agro has recently made a foray into the RTD coffee market with its newly released non-caffeinated carbonated coffee-flavored beverage called Café Cuba. Other companies such as Coke, Pepsi, Unilever and Nestle are expected to also be considering variants of RTD coffee products.

While sashimi (raw sliced seafood) has long been popular in Japan, salmon has only recently become part of the Japanese sashimi menu. It is only in the last 20 years, when farm-raised Atlantic salmon from Norway and then salmon trout from Chile began to appear in Japanese markets, that salmon sashimi began to be eaten in Japan. While Japan has long been a salmon eating country, its native salmon are wild and generally not safe for raw sashimi consumption due to parasites.

While sashimi (raw sliced seafood) has long been popular in Japan, salmon has only recently become part of the Japanese sashimi menu. It is only in the last 20 years, when farm-raised Atlantic salmon from Norway and then salmon trout from Chile began to appear in Japanese markets, that salmon sashimi began to be eaten in Japan. While Japan has long been a salmon eating country, its native salmon are wild and generally not safe for raw sashimi consumption due to parasites.