Tomatoes have never been more popular in Hong Kong. Not only has the imported tomato volume increased significantly since 2004, Hong Kong has also welcomed more varieties of tomatoes beyond the popular round tomatoes. Promar research analysts Paul Tsai and Yuan Gao visited Hong Kong to understand the current market and assess the future potential of imported tomatoes.

Tomatoes have never been more popular in Hong Kong. Not only has the imported tomato volume increased significantly since 2004, Hong Kong has also welcomed more varieties of tomatoes beyond the popular round tomatoes. Promar research analysts Paul Tsai and Yuan Gao visited Hong Kong to understand the current market and assess the future potential of imported tomatoes.

For the past 20 years, China has always been the largest exporter of tomatoes to Hong Kong- currently China holds hold approximately 90% of the market share. In 2004, Hong Kong’s import of Chinese tomato has increased by approximately 4 times in volume. Higher health conscious among Hong Kong consumers is the key factor that drove this demand. The SARS outbreak in 2003 has motivated Hong Kong consumers to eat healthier, which driven sales of fruits and vegetables upwards.

Another factor for the tomato increase is the improved quality of Chinese tomatoes. While Chinese tomatoes are still not considered the ideal ingredient for cooked food or fresh consumption, their quality and taste have improved over the past decade. Chinese tomatoes’ biggest strength has always been their low price, which is 1/3 of the price of most tomatoes importedto Hong Kong. The future for Chinese tomatoes in the market for fresh tomatoes in Hong Kong looks positive as buyers across the supply chain believe that it will continue to increase in volume.

This is not to say that non-Chinese tomatoes do not have a chance in the Hong Kong fresh vegetable market. European tomatoes imported from Italy and France are the favorites for Hong Kong consumers who demand the highest quality. Tomatoes imported from Holland with good pricing and a year-long supply are the best-selling tomato product in many high to mid-level supermarkets. Australia and Japan also offer good quality tomato products that could compete with the European products in retail. There has been a trend for Hong Kong consumers to demand higher quality western food in food service. In addition, sweeter tasting tomatoes of European origin are preferred for home consumption, especially for children. These are the key areas in which non-Chinese tomatoes have a greater advantage in the Hong Kong tomato market.

While competition between various countries is becoming more intense, the outlook for both Chinese and non-Chinese tomatoes in the Hong Kong vegetable market remains positive. In the coming years, it is possible that tomatoes could shake off their image as a secondary vegetable on the Hong Kong dining table, where they have been overshadowed by green leafy vegetables.

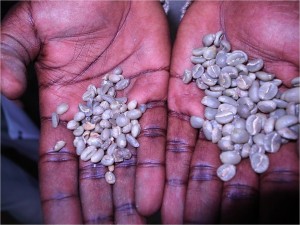

Photo: Round tomatoes from China’s Shandong Province are the best-selling products in the Hong Kong tomato market.

Promar Consulting has investigated a variety of aspects of fresh fruit and vegetable market in China, Hong Kong and other Asian countries. If you are interested in knowing more please contact us.

China has always been the largest vegetable supplier to Japan. However, there have recently been concerns in Japan that the increasing production costs – wages, land, agrichemicals, etc – could lead to a higher supply cost. Promar research analysts Paul Tsai and Leo Li explored current and future trends in production and marketing of the most popular vegetables that are coming to Japan from China.

China has always been the largest vegetable supplier to Japan. However, there have recently been concerns in Japan that the increasing production costs – wages, land, agrichemicals, etc – could lead to a higher supply cost. Promar research analysts Paul Tsai and Leo Li explored current and future trends in production and marketing of the most popular vegetables that are coming to Japan from China. English versions of Promar’s recent reports on agricultural issues in Rwanda and Tanzania are now available.

English versions of Promar’s recent reports on agricultural issues in Rwanda and Tanzania are now available. A report by Promar research analyst Andrew Lambert on Japan’s growing demand for imported vegetables was published in the February 2012 issue of Asia Fruit Magazine. The article looks at how the long-term population trends, coupled with the lingering impact of last year’s earthquake and tsunami are increasing demand for vegetable imports.

A report by Promar research analyst Andrew Lambert on Japan’s growing demand for imported vegetables was published in the February 2012 issue of Asia Fruit Magazine. The article looks at how the long-term population trends, coupled with the lingering impact of last year’s earthquake and tsunami are increasing demand for vegetable imports.

Promar continued to grow its single-client, propriety coverage of global food, beverage, and commodity markets in the last two months with the initiation of regular reports on Japan’s oilseeds and grains markets and the Chinese and Hong Kong fruit market.

Promar continued to grow its single-client, propriety coverage of global food, beverage, and commodity markets in the last two months with the initiation of regular reports on Japan’s oilseeds and grains markets and the Chinese and Hong Kong fruit market. Consultants Lucia Vancura and Ayako Kuroki spent several weeks of field research in Tanzania where they documented issues and challenges within the Nile Perch fishing and processing industry in Lake Victoria and in the banana industry in the Arusha area. They also investigated what is sometimes referred to as BOP (Base of the Pyramid) business ideas to understand how enterprises are providing new products and services to rural and poor citizens. They met several major corporations in South Africa involved in rural telecom and fertilizers as well as many entrepreneurs in Tanzania producing products like fortified and nutritious flours (at Nyirefam and AfriYouth Pride) and bicycle-powered corn shellers at Global Cycle Solutions.

Consultants Lucia Vancura and Ayako Kuroki spent several weeks of field research in Tanzania where they documented issues and challenges within the Nile Perch fishing and processing industry in Lake Victoria and in the banana industry in the Arusha area. They also investigated what is sometimes referred to as BOP (Base of the Pyramid) business ideas to understand how enterprises are providing new products and services to rural and poor citizens. They met several major corporations in South Africa involved in rural telecom and fertilizers as well as many entrepreneurs in Tanzania producing products like fortified and nutritious flours (at Nyirefam and AfriYouth Pride) and bicycle-powered corn shellers at Global Cycle Solutions.